The PURPLE MATRIX! Learn to evaluate various investment avenues.

- thepurplemoney

- Jul 7, 2019

- 4 min read

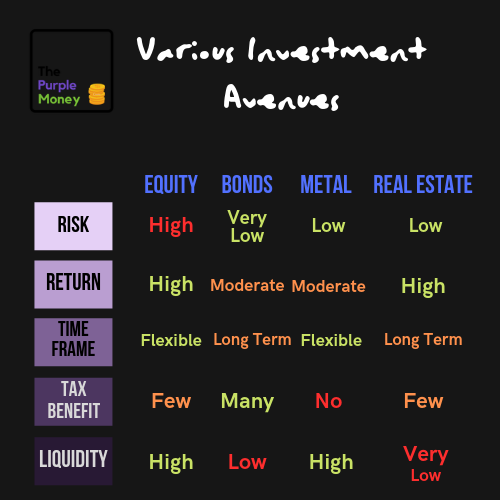

Here in this blog we will learn to evaluate various investment avenues on our Purple Matrix. Purple Matrix is a simple evaluation tool to analyse any investment on the base of five factors that matters the most while making investment decisions which are,

Risk

Return

Time Frame

Liquidity

Tax Benefits

A detailed blog on these factors is also available on the website. Check It out.

Back on our Purple Matrix we here in this article will discuss four most common Investment Avenues Indians are found investing in traditionally. In this particular blog we have taken Equity, Bonds, Precious Metals like Gold and Real Estate. All of these can be considered the Basic Investment Avenues since Indian have been conventionally fund of investing in them since generations. One section which is the HOT FAVOURITE investment avenue in India is Mutual funds! Since the availability of vast variety of schemes, perks of diversification and small token amount Mutual Funds have become India's favourite Investment avenue and we will have a separate post completely dedicated to various types of mutual funds.

Getting on our track the first avenue we will discuss in detail will be EQUITY.

Investing in Equity is simply investing in the stocks of listed public companies. Equity market is the primary market for many investor and is the first preference for a huge population due to ease in investing and high liquidity. However, one must have a bank account and a linked Demat account to invest in common stocks. The Purple Money provides a completely free demat account to all of its investing community members. Join Now.

Investing in Equity also requires in depth knowledge of various industries and companies investors are willing to invest in. For this particular reason a lot of investors rely on their brokers and portfolio managers. It is preferred to hire one if investors do not completely understand the industry since picking a wrong stock puts investors money in a highly risky asset. The perks of investing in Equity is that technology and dematerialization of securities have made buying and selling stocks very easy. All the transactions can be completed and tracked through simple mobile applications. Investors also have a variety of companies to invest in and can benefit from diversifying the portfolio. A sound portfolio of selective large cap funds can always beat inflation and easily provide 7 to 8% returns.

The second asset class we will discuss is Gold.

Gold is one of the most favourite investment avenue for Indian investors. The obsession of Indian women with Gold has led to make India with the highest gold possession in the world with estimated 24,000 tons. Most of which is in the form of Jewelry. The quality of being tangible unlike equity shares make it preferable among other asset class. Also, gold can be bought by any layman without having any demat or blank account. Gold is also highly liquid. One can easily liquidate it in any Jewelry store. One most important quality f Gold is that it works as a hedge against the Stock Market. In a simple language, when stock markets fall or are expected to fall investors shift to a stable security, GOLD. So, when markets fall, due to the hike in demand of gold, gold prices tend to rise. this way investors holding stocks in a portfolio can hedge the risk by holding a portion in Gold. It is also not mandatory for investors to hold it in physical form. Investors can also buy Gold ETF's. This way gold can be a nice fit to take a space in the investors portfolio.

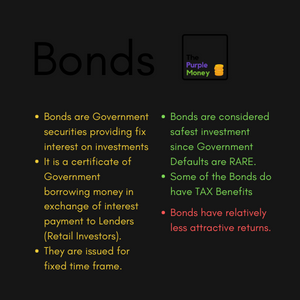

The third asset to be discussed will be BONDS.

Bonds are government securities issued by the Government to raise money for various projects. Here, Government is the borrower of money and Investors are lenders. Which means government will pay fixed interest on issued bonds on a yearly bases until maturity and will repay borrowed money on maturity day. This means that Bonds are issued for a fixed period of time and they expire on maturity date. Bonds pay returns close to the Fixed deposits, in most cases a little more than Fixed deposits. Which is not an attractive return however the man perk of Bonds is the Tax Benefits associated with it. Many government bonds are Tax Saving while few Bonds like Indian Railway Finance Corporation Bonds are completely TAX-Free. Bonds are less liquid in nature compared to Equity stocks but are preferred investments for long term.

The final Investment Avenue we will discuss is REAL ESTATE.

Real Estate and Land ha been popular investment avenues in a nation like India where over 60% of population still relies on Farming and Agriculture. Land and Property has always been a symbol of status and prosperity. However, they are excellent investment avenues too. Investing in Land and Real Estate can be bifurcated into two major sections.

Land

Property

And both of these categories can gain bifurcated into to major categories accordingly ,

Land according to the Tenure

Agricultural Land

Non Agricultural Land

And Property according to Utility

Residential Property

Commercial Property

In both cases Non Agricultural Land and Commercial Property are considered better investment avenues due to increased Utility and potential for monetary gains.

Real Estate is not liquid investment thus it can only be considered under long term investment goals. It easily beats the Inflation in long run but also requires huge investments. Investors can get a TAX Shield on property investments by showcasing it to be self occupied. however, only one property can be published self occupied by an individual.

Since we have discussed all the Investment avenues, The Purple Matrix for these investments will be provided below to help you take further investment decisions.

Comments